Jobs with Sign-On Bonuses: Get Paid to Start Your New Career

Looking for a job that pays you to start? You're in the right place. At Gen Z Jobs, we spotlight jobs that offer sign-on bonuses ranging from $500 to over $50,000. These upfront cash incentives are designed to attract talented professionals across industries.

In today's competitive job market, employers use sign-on bonuses to fill critical roles faster. Whether you're a nurse, truck driver, software engineer, or skilled tradesperson, signing bonuses can add thousands of dollars to your compensation package in your first year. Browse hundreds of verified positions below, all offering sign-on bonuses and updated daily.

Sign-On Bonus Amounts by Industry (2025)

Sign-on bonuses vary widely based on industry, experience level, and location. Here's what you can expect across major sectors.

Healthcare

Registered nurses in staff positions typically receive $5,000 to $15,000 in sign-on bonuses. Travel nursing contracts often include $1,000 to $3,000 per assignment. Critical care and ICU nurses can command $10,000 to $25,000, while positions in rural or underserved areas may offer up to $40,000 or more.

Physical therapists see bonuses ranging from $3,000 to $10,000. Radiologic technologists typically receive $2,000 to $7,500. Respiratory therapists can expect $3,000 to $8,000, while medical assistants generally see more modest bonuses of $500 to $2,000.

Logistics and Transportation

CDL truck drivers represent one of the largest categories for sign-on bonuses. Local and regional drivers typically receive $1,000 to $5,000. Long-haul and over-the-road positions offer $5,000 to $15,000. Specialized drivers handling hazmat or tanker loads can command $10,000 to $20,000.

Warehouse and logistics positions also offer bonuses. Forklift operators typically see $500 to $2,000. Warehouse supervisors can expect $2,000 to $5,000, while fleet managers may receive $3,000 to $10,000.

Search all Logistics & Transportation jobs with sign-on bonuses

Technology

Software engineers at the entry level typically receive $5,000 to $15,000 in sign-on bonuses. Mid-level engineers see $10,000 to $30,000. Senior and specialized positions can command $20,000 to $50,000 or more, particularly in high-demand areas like artificial intelligence and machine learning.

Cybersecurity professionals are in high demand. Security analysts typically receive $8,000 to $20,000. Penetration testers see $10,000 to $25,000. Chief Information Security Officers at large companies can command $25,000 to $75,000 or more.

Skilled Trades

Electricians typically receive $2,000 to $8,000 in sign-on bonuses. HVAC technicians see similar ranges of $2,000 to $7,000. Welders, particularly those with specialized certifications, can expect $2,000 to $10,000. Plumbers generally receive $2,000 to $6,000, while general maintenance technicians see $1,000 to $5,000.

Search all Skilled Trades jobs with sign-on bonuses

Education

Teachers in high-demand subjects like STEM, special education, and bilingual education can receive $2,000 to $15,000 in sign-on bonuses. Rural districts facing severe shortages sometimes offer up to $20,000. Standard teaching positions in well-staffed districts typically offer $1,000 to $5,000.

Search all Education &Training jobs with sign-on bonuses

What Determines Bonus Amount?

Several factors influence the size of your sign-on bonus. Experience level plays a major role, as more seasoned professionals command higher bonuses. Skill scarcity matters significantly. If your specialty is difficult to fill, employers will pay more to secure talent.

Geographic location affects bonus amounts substantially. High cost of living areas and rural regions struggling to attract talent both tend to offer higher bonuses. Company size also matters, with larger corporations typically able to offer more substantial bonuses than small businesses.

Market demand fluctuates based on economic conditions and industry trends. Crisis situations, like the nursing shortages during the pandemic, can drive bonuses significantly higher. Finally, if relocation is required, employers often sweeten the deal with larger bonuses to offset moving costs and encourage candidates to make the leap.

Types of Sign-On Bonuses

Not all sign-on bonuses work the same way. Understanding the structure helps you evaluate offers and plan your finances accordingly.

Lump Sum Payment

The most straightforward type is the lump sum payment, where you receive the entire bonus at once. Typically, this arrives with your first paycheck or after 30 to 90 days of employment. This structure is most common for bonuses under $10,000.

The advantage of lump sum payments is immediate cash access. You can use the funds right away for moving expenses, paying off debt, or building savings. However, the downside is higher tax withholding upfront. Since the entire amount hits your income in one pay period, the tax bite can feel substantial.

Installment Payments

Some employers split the bonus across multiple payments over 6 to 24 months. For example, a $12,000 bonus might be paid as $3,000 quarterly for one year. Another common structure is half upfront and half after completing six months of employment.

Installment payments spread out the tax burden, which can be easier to manage. This structure also ensures you stay with the company long enough to collect the full amount. The downside is delayed access to the full payment. If you need cash immediately for relocation or other expenses, this structure may be less appealing.

Performance-Based Bonuses

Some sign-on bonuses are contingent on meeting specific goals or milestones. These might include completing certain training programs, achieving performance metrics, or obtaining required certifications within a timeframe.

Performance-based bonuses can be higher than standard sign-on bonuses because they carry more risk for the employee. The major drawback is uncertainty. Unlike guaranteed bonuses, you may not receive the full amount if circumstances prevent you from meeting the conditions.

Retention Bonuses

Similar to signing bonuses but structured differently, retention bonuses are paid after you complete a specific employment period. The payment typically comes after 6 to 12 months of continuous employment.

Retention bonuses often carry higher amounts than standard sign-on bonuses because they serve dual purposes: attracting talent and ensuring retention. However, you must remain employed for the entire period to receive payment. If you leave before the term ends, you receive nothing.

What You Need to Know About Sign-On Bonuses

Repayment Clauses

This is the most critical aspect of any sign-on bonus agreement. Most bonuses include repayment terms if you leave before a certain period. The standard timeframe ranges from 6 to 24 months, though 12 months is most common.

Repayment structures vary by employer. Some require full repayment if you leave within the first six months. Others prorate the amount based on how long you stayed. For example, if you leave after six months of a 12-month commitment, you might repay 50 percent of the bonus.

Always read the fine print carefully before accepting an offer. You need to understand exactly how long you must stay to keep the bonus. Determine whether repayment is prorated or all-or-nothing. Find out what happens if you're terminated without cause rather than choosing to leave voluntarily. Some companies waive repayment if they terminate you, while others still require it. Also clarify whether you repay the gross amount received or the net amount after taxes.

The repayment clause should be clearly spelled out in your offer letter or employment contract. If it's not, request written clarification before accepting the position. Verbal promises about bonuses or lenient repayment terms are not enforceable.

Tax Implications

Sign-on bonuses are taxable income, and they're typically withheld at a higher rate than regular wages. The federal government treats bonuses as supplemental income, which means they're withheld at a flat 22 percent for amounts under $1 million. State taxes apply on top of federal withholding, and you still owe FICA taxes (Social Security and Medicare).

Here's a realistic example. If you receive a $10,000 signing bonus, expect roughly $2,200 in federal withholding. State taxes will take another $500 to $1,000 depending on where you live. FICA taxes add approximately $765. Your net payment will be somewhere between $6,500 and $7,000, not the full $10,000.

If you're in a higher tax bracket, the withholding might not cover your full tax liability. Consider setting aside additional funds at tax time to avoid surprises. Conversely, if you're in a lower bracket, you may get some of the withholding back as a refund when you file your return.

One important consideration about repayment: if you have to repay your bonus, you typically repay the gross amount, not the net amount you received. So in the example above, you'd repay $10,000 even though you only netted $6,500. You can claim a deduction for the repaid amount, but navigating that on your taxes can be complex.

We here at GenZJobs are tax pros, so please talk to a trusted person and/or tax professional to get guidance for your specific situation.

Negotiation Tips

Sign-on bonuses are often negotiable, even if they weren't included in the initial offer. Your leverage is strongest when you're leaving money on the table at your current job, need to relocate for the new position, have competing offers from other companies, or possess in-demand skills that are hard to find.

Timing matters for negotiation. The best time to discuss a sign-on bonus is after you've received a formal offer but before you've accepted it. Once you've verbally accepted, your negotiating position weakens significantly.

Frame your request professionally and tie it to concrete circumstances. For example: "I'm very excited about this opportunity and eager to join your team. I'm currently leaving behind a $5,000 year-end bonus at my current position by departing before December. Would you be able to include a sign-on bonus to help offset this?" This approach is reasonable, specific, and gives the employer a clear rationale for saying yes.

If you're relocating, you can make a similar case: "I'm thrilled about this role and ready to relocate to Chicago. Moving my household across the country will cost approximately $8,000. Could we discuss a sign-on bonus or relocation assistance to help cover these expenses?"

Research industry standards before negotiating. If nurses in your specialty typically receive $10,000 to $15,000 bonuses and you're offered $5,000, you have data to support requesting more. If the employer says bonuses aren't possible, consider negotiating other elements like extra vacation days, flexible scheduling, or a higher base salary.

Red Flags to Watch For

Be cautious of suspiciously high bonuses that far exceed industry standards. If entry-level positions typically offer $2,000 bonuses but you're being offered $15,000, investigate why. It could signal high turnover, a terrible work environment, or unrealistic performance expectations.

Vague repayment terms are another red flag. If the offer letter doesn't clearly specify the repayment period, the amount you'd owe, or the circumstances that trigger repayment, push for clarity. Ambiguous terms give the employer too much discretion and leave you vulnerable.

Never accept a verbal promise of a bonus without written documentation. If a recruiter or hiring manager says "We'll give you a $10,000 bonus" but it's not in your offer letter, it doesn't exist. Always insist on written confirmation of the bonus amount, payment timing, and repayment terms.

Be wary of bonuses tied to unrealistic performance goals. If you must achieve metrics that no one else has reached, or if the goals rely on factors outside your control, the bonus is essentially illusory. Ask to see historical data on how many employees actually received the full bonus.

Finally, research the company's turnover rate and reputation. If an employer offers generous bonuses but has terrible reviews from former employees, the bonus might be a desperate attempt to fill positions no one wants. High bonuses don't compensate for toxic work environments or unethical practices.

Sign-On Bonus FAQs

When do you receive a sign-on bonus?

Timing varies by employer, and there's no universal standard. The most common schedule is receiving your bonus with your first paycheck. Many employers pay it after 30 days of employment to ensure you're going to stay. Some companies require you to complete a 60 to 90 day probationary period before paying the bonus. Others split the payment into installments over 6 to 12 months.

Always confirm the timing in writing before accepting an offer. If it matters to you whether you receive the bonus immediately or after several months, clarify this during negotiations. Some employers are flexible on timing, especially if you're relocating and need funds upfront for moving expenses.

Are sign-on bonuses guaranteed?

Yes, if the bonus is included in your written offer letter and you meet the stated conditions. Those conditions typically include starting work on the agreed date and remaining employed for a minimum period. The key phrase is "in writing." Verbal promises, no matter how sincere, are not legally binding.

Review your offer letter carefully to understand exactly what conditions you must meet to receive the bonus. If anything is unclear, ask for clarification before accepting. Once you've satisfied the conditions, the employer is legally obligated to pay you the bonus as described.

Never rely on informal assurances or vague promises. If your recruiter says "We usually give bonuses to new hires" but it's not in your offer letter, you have no guarantee of receiving one. Always get it in writing.

What happens if I quit before the repayment period ends?

You'll typically owe back all or part of the bonus, depending on your company's specific repayment policy and how long you stayed. The exact amount depends on three factors: the length of time you remained employed, your company's repayment policy, and whether your departure was voluntary or involuntary.

Some companies use an all-or-nothing approach. If you leave before completing the full retention period (often 12 months), you must repay the entire gross amount. Other companies prorate the repayment. If you stay for 6 months of a required 12 months, you might only repay 50 percent of the bonus.

The repayment usually covers the gross amount, not the net amount you received after taxes. So if you received a $10,000 bonus but netted $7,000 after taxes, you'd still repay $10,000. You can claim a deduction for the repaid amount on your taxes, but you need to work with a tax professional to do this correctly.

If you're terminated without cause, policies vary significantly. Some employers waive repayment if they terminate you. Others still require repayment regardless of who initiated the separation. This distinction should be clearly spelled out in your employment agreement. If it's not, you're vulnerable to being required to repay even if you're laid off through no fault of your own.

Do I pay taxes on a sign-on bonus?

Yes, sign-on bonuses are taxable income. The IRS treats them as supplemental wages, which are subject to different withholding rules than regular salary. For bonuses under $1 million, federal law requires employers to withhold at a flat rate of 22 percent. State income taxes apply on top of federal withholding, with rates varying by state. You also owe FICA taxes, which include 6.2 percent for Social Security and 1.45 percent for Medicare.

The withholding happens when you receive the payment. Your employer will include the bonus amount in Box 1 of your W-2 at tax time. Depending on your total annual income and tax bracket, you may owe additional taxes or receive a refund.

If you're in a tax bracket higher than 22 percent, the withholding may not fully cover your tax liability on the bonus. Consider setting aside extra money for taxes to avoid a surprise bill at tax time. Conversely, if your effective tax rate is lower than 22 percent, you'll likely receive part of the withholding back as a refund when you file your return.

We here at GenZJobs are tax pros, so please talk to a trusted person and/or tax professional to get guidance for your specific situation.

Can you negotiate a sign-on bonus if one wasn't offered?

Absolutely, and it's more common than many people realize. Sign-on bonuses are often negotiable elements of compensation packages, particularly if you can make a compelling business case for why you deserve one.

Your leverage is strongest in several situations. If you're forfeiting a bonus at your current job by leaving before the payout date, most employers understand that's real money you're giving up. They may be willing to offset that loss with a sign-on bonus. If you need to relocate for the position, moving expenses provide another solid justification. If you have unique, in-demand skills that are hard to find, or if you're fielding competing offers from other companies, you have additional negotiating power.

Frame your request professionally and tie it to specific circumstances. Instead of simply asking "Can you add a sign-on bonus?" try something like: "I'm very excited about joining your team. I'm currently forfeiting a $7,500 year-end bonus by leaving my current position in October rather than waiting until December. Would you be able to include a sign-on bonus to help offset this?"

Even if you don't have a bonus at risk, you can still ask. The worst they can say is no. A simple approach is: "I'm thrilled about this opportunity. Is there any flexibility to include a sign-on bonus as part of the compensation package?" If they can't offer a bonus, consider negotiating other elements like extra vacation time, a flexible schedule, or a slightly higher base salary.

What's the difference between a sign-on bonus and a relocation bonus?

These are two distinct benefits, though some employers bundle them together or use the terms interchangeably. A sign-on bonus is a cash incentive for accepting the job, regardless of whether you need to relocate. You can spend it however you choose. It's compensation for choosing that employer over other opportunities.

A relocation bonus specifically covers moving expenses. It might be paid directly to a moving company, reimbursed to you after you submit receipts, or given as a lump sum designated for moving costs. Relocation packages often include other benefits beyond cash, like temporary housing, home-finding trips, or assistance selling your current home.

Some offers include both a sign-on bonus and separate relocation assistance. This is ideal because you get cash compensation plus help with moving expenses. However, clarify which you're receiving and whether any portion of the sign-on bonus is expected to cover moving costs. If your offer includes a $10,000 sign-on bonus but your employer expects you to use it for relocation, that's different from receiving a $10,000 bonus plus separate relocation assistance.

Get the distinction clear in your offer letter. If relocation is required and expensive, negotiate for both if possible. At minimum, ensure the sign-on bonus is large enough to cover your moving costs with money left over.

Are sign-on bonuses common for entry-level positions?

They're less common than for experienced positions, but increasingly used in high-demand fields. Entry-level bonuses are typically modest, ranging from $500 to $5,000, compared to the five-figure bonuses experienced professionals might receive.

Healthcare offers entry-level bonuses frequently. Nursing assistants, medical assistants, and patient care technicians often receive $500 to $3,000 bonuses in markets facing shortages. Warehouse and logistics companies regularly offer entry-level bonuses of $500 to $2,000 for positions like forklift operators and package handlers, particularly during peak seasons.

Skilled trades apprenticeships sometimes include bonuses of $1,000 to $5,000 to attract young workers to industries facing workforce shortages. Tech companies, even for early-career software engineers, may offer $5,000 to $15,000 bonuses, though this is more common at larger companies competing for talent from top universities.

If you're applying for entry-level positions, don't expect a bonus automatically, but don't be afraid to ask if you have competing offers or unique qualifications. The worst they can say is that bonuses are only offered to experienced hires. But in tight labor markets, even entry-level candidates have more negotiating power than they realize.

What's better: a higher salary or a sign-on bonus?

Generally, a higher base salary is better for long-term financial health, even if it means a smaller or no sign-on bonus. Base salary impacts your lifetime earnings in ways a one-time bonus cannot match.

Every raise you receive is calculated as a percentage of your base salary. If you're earning $60,000 and receive a 3 percent raise, that's $1,800 per year. But if you negotiated up to $65,000 base, that same 3 percent raise is $1,950. Over a 30-year career, that difference compounds significantly. Company benefits tied to salary percentages, like 401(k) matching or pension contributions, are also based on your base pay. A higher salary means more retirement savings automatically.

Base salary affects your future earning potential beyond your current company. When you job hop, your new employer often asks about your current salary or bases their offer on it. Starting from a higher base gives you more negotiating power for future positions.

That said, sign-on bonuses aren't worthless. They provide immediate cash that can be useful for specific purposes like paying off debt, building an emergency fund, or covering moving expenses. The ideal scenario is negotiating both a competitive base salary and a sign-on bonus. Use the bonus for immediate needs, but prioritize base salary for long-term wealth building.

Here's a quick comparison. A $5,000 per year salary increase over 5 years equals $25,000 plus compounding raises on that higher base. A one-time $5,000 sign-on bonus equals $5,000 total. The salary increase wins every time for long-term financial health.

Do you have to report a sign-on bonus on your taxes?

Your employer reports it for you, so it will appear on your W-2 in Box 1 along with your regular wages. You don't have to do anything special to report it separately. The bonus is included in your total wages, tips, and other compensation for the year.

Taxes are typically withheld from your bonus when you receive it, so you've already paid estimated taxes on that income. When you file your tax return, the W-2 will show both the bonus income and the taxes already withheld. Depending on your total income for the year and your tax bracket, you may owe additional taxes or receive a refund.

If you repay any portion of your sign-on bonus because you left before the retention period ended, you can claim a deduction for the repaid amount. This is more complex and usually requires help from a tax professional. The deduction doesn't happen automatically, so you need to track the repayment and claim it properly on your return.

Can a company take back a sign-on bonus?

Yes, if you violate the terms of your employment agreement or leave before the retention period ends. This is why the repayment clause in your offer letter is so important. Most companies include clear terms about when you must repay the bonus.

If you voluntarily resign before completing the required retention period, the company can absolutely require repayment. You agreed to this when you accepted the offer. If you're terminated without cause (meaning you didn't do anything wrong, but the company eliminated your position or decided you weren't a good fit), policies vary. Some companies waive repayment in this situation. Others still require it. This should be spelled out in your employment contract.

State laws also affect what companies can do. Some states limit an employer's ability to demand repayment from final paychecks or take other aggressive collection actions. If you find yourself in a dispute over bonus repayment, consult an employment attorney familiar with your state's laws.

The best protection is to understand the terms before accepting the offer. Read every word of the bonus repayment clause. If anything is unclear or seems unfair, negotiate different terms or ask for clarification before signing. Once you've accepted, you're bound by those terms.

How to Find Jobs with Sign-On Bonuses

On Gen Z Jobs

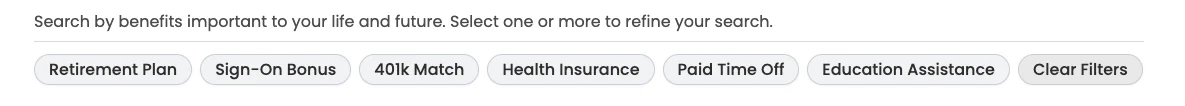

Use the sign-on bonus filter in our job search to view only positions offering bonuses. Browse by industry to focus on high-demand sectors like healthcare, transportation, or technology. Check job descriptions carefully, as some employers mention bonus amounts in the posting while others discuss it during interviews. Look for keywords like "hiring bonus," "signing incentive," "welcome bonus," or "retention bonus" in job descriptions.

The benefits filter is available on all of our job pages and it looks like this.

During Your Job Search

Ask recruiters directly whether positions include sign-on bonuses. Many companies offer them but don't advertise it publicly. Check company career pages for information about hiring incentives, particularly during job fairs or seasonal hiring pushes. Research industry standards for your role and location to understand what you should expect.

Not all job postings advertise bonuses upfront. Some companies prefer to discuss compensation details during interviews or when extending offers. Don't assume a job doesn't offer a bonus just because it's not mentioned in the posting.

Red Flags to Watch During Your Search

Be extremely cautious of positions advertising extraordinarily high bonuses for entry-level work with no experience required. If something sounds too good to be true, it usually is. Watch for "bonuses" that are actually commission-based earnings or depend entirely on performance metrics. These aren't guaranteed sign-on bonuses.

Never pay upfront fees or expenses to receive a bonus. Legitimate employers don't charge application fees or require you to purchase equipment or uniforms before starting work. Be wary of vague companies with no online presence, poor reviews, or unclear business models. Research any company thoroughly before accepting an offer, especially if they're offering unusually generous bonuses.

Top U.S. Cities for Sign-On Bonus Jobs

Sign-on bonuses are available nationwide, but certain metro areas offer more opportunities and higher amounts due to cost of living, industry concentration, or worker shortages.

High-Demand Healthcare Markets

New York City leads the nation with nursing bonuses reaching up to $30,000 for experienced RNs, particularly in critical care. Los Angeles offers healthcare bonuses ranging from $10,000 to $25,000 across specialties. Boston provides some of the highest nursing incentives in the country, with registered nurses seeing $15,000 to $35,000 bonuses, especially in teaching hospitals. Chicago healthcare workers can expect $8,000 to $20,000 depending on specialty and facility type. San Francisco combines high tech and healthcare demand, with bonuses ranging from $15,000 to $50,000 or more.

Transportation and Logistics Hubs

Dallas and Fort Worth together form one of the largest transportation hubs in the nation. CDL drivers see bonuses from $5,000 to $15,000. Houston, with its port and oil industry, offers logistics bonuses of $3,000 to $10,000. Atlanta serves as a major distribution center, with warehouse and driver bonuses ranging from $2,000 to $12,000. Phoenix continues growing as a logistics hub, offering transportation bonuses of $4,000 to $10,000. Indianapolis, centrally located for distribution, provides logistics bonuses from $2,000 to $8,000.

Technology Centers

Seattle remains a tech powerhouse with software engineer bonuses ranging from $15,000 to $50,000 or higher for specialized roles. Austin's growing tech scene offers bonuses of $10,000 to $40,000 for software engineers and data scientists. Denver attracts tech talent with bonuses of $10,000 to $35,000. San Diego combines tech and healthcare opportunities, with bonuses from $12,000 to $45,000 depending on the sector.

Growing Markets

Charlotte has emerged as a financial and healthcare center, offering bonuses of $5,000 to $20,000. Nashville's healthcare industry drives bonuses of $7,000 to $18,000 for medical professionals. Raleigh and Durham's Research Triangle attracts tech and healthcare workers with bonuses ranging from $8,000 to $25,000.

Rural Opportunities

Don't overlook rural areas. Small towns and rural regions often offer the highest bonuses relative to cost of living because they struggle most to attract workers. Rural hospitals may offer $20,000 to $40,000 bonuses for nurses. Small school districts in remote areas sometimes offer teachers $10,000 to $20,000. Rural manufacturers and processors may provide $5,000 to $15,000 bonuses for skilled trades workers. Check specific job listings for location-based incentives that might exceed what major metros offer.

Industries Currently Offering the Most Sign-On Bonuses

Based on current market conditions in October 2025, certain industries are offering more bonuses and higher amounts than others.

Healthcare Leads the Way

The critical nursing shortage continues to drive bonuses from $10,000 to $40,000 for registered nurses, especially in intensive care, emergency rooms, and rural facilities. Allied health professionals like physical therapists, occupational therapists, and respiratory therapists are also seeing strong bonus offers. Home healthcare workers are in particularly high demand as the population ages.

Transportation Remains Strong

The CDL driver shortage shows no signs of abating. Long-haul drivers can expect consistent $5,000 to $20,000 bonuses, particularly for specialized freight like hazmat or refrigerated transport. Local delivery drivers for e-commerce companies are seeing $2,000 to $8,000 bonuses during peak seasons.

Skilled Trades Face Workforce Gaps

An aging workforce creates gaps across skilled trades. Electricians, HVAC technicians, and welders see $2,000 to $10,000 bonuses. Solar installation technicians and wind turbine technicians are emerging high-demand specialties with bonuses of $3,000 to $12,000. Manufacturing facilities desperate for skilled maintenance workers offer $5,000 to $15,000.

Technology Remains Competitive

Despite economic shifts and layoffs in some tech sectors, cybersecurity and artificial intelligence engineers still command $15,000 to $50,000 bonuses or more. Cloud architects, DevOps engineers, and data scientists with specialized skills continue to see strong bonus offers. Software engineers with expertise in emerging technologies like blockchain or quantum computing can negotiate particularly high bonuses.

Education Faces Shortages

Teacher shortages, particularly in STEM subjects, special education, and bilingual education, drive bonuses of $2,000 to $20,000. Rural school districts offer the highest bonuses, sometimes reaching $25,000 for math and science teachers willing to commit to multi-year contracts. Urban districts in high-cost areas also offer substantial bonuses to compete with private sector salaries.

Warehouse and Logistics Growth Continues

E-commerce growth shows no signs of slowing, creating consistent demand for warehouse workers. Forklift operators and warehouse supervisors get $500 to $5,000 bonuses, particularly during fourth quarter holiday season hiring pushes. Distribution center managers and logistics coordinators can expect $5,000 to $15,000.